公益创投是什么¶

当我们谈论公益创投时,我们在谈什么?

公益创投起源¶

“公益创投”这个术语最早可以追溯到1960年代的美国,但是直到1990年代这个术语才开始变得流行起来,并引发了对于基金会高度参与的捐赠基金这种新模式的争辩。一份由Letts,Ryan和Grossman联合撰写的一篇发布在《哈佛商业评论》上的极具影响力的文章中(Letts, C., Ryan, W. and Grossman, A. (1997)“良性资本:基金会可以向风险投资者学到什么”,哈佛商业评论),质疑了基金会采用风险投资的方式投资于社会目的型组织的机构是出于其自身需要而并非组织本身需要。

Porter和Kramer (Porter, M.E. and Kramer, M.R.(1999) “公益事业新议程:创造价值”,哈佛商业评论) 后来又挑战了基金会声称创造更大的价值、但却只是充当将资金从私人渠道转移到被资助者的被动渠道功能。在英国,对于社会投资创新工具的兴趣,包括高度参与的模型,在2001年开始发展起来。那时发生了一些具有历史意义的类似风险投资的活动,直到2002年,英国的第一家公益创投机构 Impetus Trust成立。

在欧洲大陆,人们对于社会投资和慈善高度参与的慈善模型的兴趣日渐浓厚。欧洲公益创投协会于2004年成立,它是鼓励公益创投模型在欧洲发展的主要驱动力。Douglas Miller是欧洲公益创投协会的创始人兼主席,他在2011年创建了亚洲公益创投协会来支持并加速公益创投在亚洲的发展。

公益创投无法避免怀疑论者的质疑,但是它有潜力使社会投资市场更加灵活和多元化。公益创投关注于在具备社会企业家精神的社会目的型组织中构建组织能力、匹配适当的融资需求与提出战略性商业建议,这些都使公益创投成为与众不同的资金供给者。欧洲的公益创投与私募资本以及风险投资市场有强大的关联,这使它有机会影响欧洲主流金融服务机构的企业社会责任。

定义¶

欧洲公益创投组织(EVPA)给出的定义如下:

公益创投旨在建立更加强大的社会组织,它通过向公益组织提供财务和非财务的支持,扩大组织的社会影响力。被支持的组织可以是慈善机构、社会企业或社会效益驱动型的商业,具体的组织形式以特定国家的法律和文化规范为准。

公益创投拥有一些普适的关键特征,具体包括:

- 高度承诺:公益创投者与所支持的社会目的型组织有紧密的联系,从而推动社会改变的创 新模式和可扩展模式。一些公益创投者可能成为这些组织的股东,每个公益创投机构支持的公益 组织数量大大减少了,平均而言是10-15个,所有的公益创投者都比其他形式的慈善更紧密涉足 于战略和运营层面上的工作。

- 定制融资方案:正如在风险投资中一样,公益创投者采用投资策略为每一个组织制定最适 宜的融资途径。公益创投者根据他们的使命和支持的资本类型,在可接受的投资回报范围内实现 运营。一些公益创投者提供无偿的资助(从而获得一种纯粹的社会收益),另一些使用贷款、夹 层或准股票融资(从而获得混合的风险调整后财务和社会收益)

- 长期支持:公益创投者为少量的组织提供大量并长久的资助。支持时间一般是3-5年,在 欧洲的公益创投支持时间往往更长。公益创投机构的目标是在资助期结束前,社会目的型组织可 以实现财务上的自给自足。

- 非财务性支持:除了财务支持,公益创投者还提供增值服务,例如战略规划、市场顾问,以及连接其他资源网络和潜在资助者的途径。

- 组织能力建设:公益创投者关注于建造投资组合整体的运营能力和长期有效性,而非资助 单个项目。他们认识到资助核心运营成本来帮助组织实现更大社会影响力和运营效率的重要性。

- 绩效衡量:公益创投投资是基于绩效的,它强调好的商业计划、可衡量的成果、里程碑事 件的实现、财务问责制度和管理竞争力。

利益相关方¶

- 资助者:主要是基金会,风险投资/私募股权投资輸, 高净值人士(多数来自于金融业或商业界,包括 企业家)和机构。投资者主要期盼他们的〃投资〃 能回报社会。影响力投资者可能会答应给资助者一定的资金回报

- 公益创投机构:为目标组织(投资者)提供量身定制的融资和人力资源,期望通过投资带来一定的社会回报。所有的资金回报通常会被机构回收,投资于新的项目。某些影响力投资者可以从社会企业寻求有竞争力的经济回报

- 获资企业:社会目的型组织(Social Purpose Organization ),包括处于发展关键时期的非营利机构和社会企业。

注:在这里并没有把公众和政府列入。

公益创投的目标¶

益创投并非对所有的社会目的型组织都适用,正如风险资本并非始终适用于商业生命周期的所有阶段。

一般而言,公益创投最适合于需要资本的注入来实现运营中“阶段性改变”的社会目的型组织。对于一些社会目的型组织来说,公益创投意味着提供资助将它们的运营模型复制到一个新的、或是更加广泛定义的目标市场中。对于一些更加成熟的社会目的型组织来所,公益创投资助可能在其组织运营不佳、期望重新设计核心战略或重构运营时是适用的。

公益创投的六大关键特征被涵盖在公益创投的定义中,一些其他因素决定了公益创投机构具体的具体战略选择,如关注和努力的重点放在哪。不同的公益创投组织在生命周期的不同阶段将关注于不同类型的社会目的型组织。最近,公益创投机构在社会部门(如儿童、教育、养老、贫困问题等)、地理位置和被资助者的生命周期阶段展现出日益专业化的势头。这种发展来源于对于公益创投机构的逐渐的认可,人们认为它可以通过积累专业化的知识更有效地支持被资助者,从而促进投资组合中的社会联络和知识分享。如下的表格展示了公益创投目标的特征:

| 目标特征 | 概览 |

|---|---|

| 1.支持组织的类型 | •大多数公益创投资助非营利性组织和慈善组织。社会企业和社会效 益驱动的营利性企业正日益成为社会投资或影响力投资的资助对象。 •大多数公益创投活动是与中小组织开展的(在欧洲,年收入在50万 美元到500万美元之间;在亚洲,年收入在5万美元到200万美元之间)。 •组织的CEO和董事会管理层拥有强大的领导才能。领导者们具有社 会企业家精神。 |

| 2.组织发展阶段 | •公益创投家一般想将资源导向拥有成长潜能的年轻中小型组织,或 需要资金注入扩大规模、并购或实现转型的企业。公益创投资助通常是 商业计划、初步试验或初创资助后的有效的后续支持者。 |

| 3.社会部门聚焦 | •随着公益创投日益成熟,公益创投机构越来越倾向于聚焦某一个、 或某几个社会部门。它们意识到运用部门专业化的知识更好地帮助受资 助者、并为整个部门带来生态系统改变的重要性。 |

| 4.地理聚焦 | •大多数公益创投机构在本国市场运营,一些公益创投机构在国家/地 区的区域内运营。在欧洲和北美,有关注于发展中国家的公益创投资金。 在亚洲,香港特别行政区和新加坡是区域性金融和慈善的中心。 |

Venture philanthropy Definition¶

WikiPedia¶

Venture philanthropy takes concepts and techniques from venture capital finance and business management and applies them to achieving philanthropic goals.

Examples¶

The Centre for Effective Altruism spun off a venture philanthropy project in 2014, called Effective Altruism Ventures. Other examples of this type of venture philanthropy are New Profit Inc. in Boston, the Robin Hood Foundation in New York City, Tipping Point Community in the San Francisco Bay Area, The Research Acceleration and Innovation Network (TRAIN) initiative from FasterCures, the Asian Venture Philanthropy Network (AVPN), and the European Venture Philanthropy Association (EVPA).

European Venture Philanthropy Association (EVPA )¶

Venture philanthropy and social investment are about matching the soul of philanthropy with the spirit of investment (投资的精髓), resulting in a high-engagement (高度参与) and long-term approach (长期的计划) to creating social impact (产生社会影响).

Further explanation¶

While European societies need new and innovative models to tackle societal issues, social enterprises and social purpose organizations (SPOs) lack stable funding, capacity and partnerships to take up their own, ever-increasing challenges.

This is where venture philanthropy and social investment come in.

Venture philanthropy (VP) and social investment (SI) address the growing need for support and flexible funding. Through three core practices, VP/SI offers an effective, high-engagement and long-term approach to supporting SPOs in generating social impact.

通过三方面的核心实践,为了让社会组织产生社会效益,公益创投为其提供有效的、高度参与、长期的支持。

Tailored financing 个性化金融安排/投资

Venture philanthropists use a wide range of financing mechanisms (including grants, debt, equity hybrid financing…) tailored to the specific needs of the supported organization.

Organizational support 机构支持

Added value support services to strengthen the SPO’s organizational resilience and financial sustainability, by, for instance, developing skills or improving structures and processes.

Impact measurement and management 绩效评估与管理

Impact measurement helps pinpoint what works and what doesn’t, so you can manage your impact better. This is why we talk about impact ‘management’ rather than ‘measurement’ or ‘assessment’.

上图:公益创投的三个核心

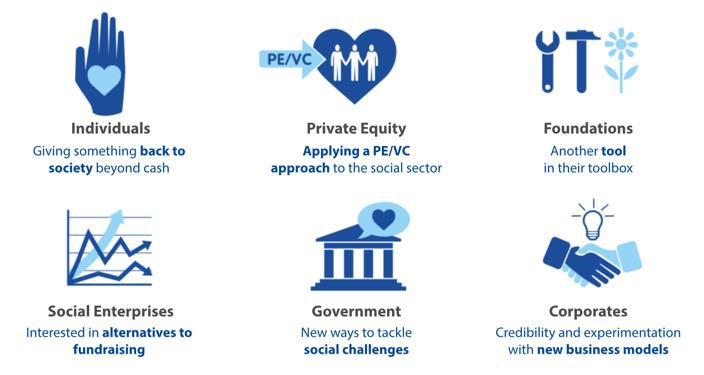

Key stakeholders in venture philanthropy¶

Why use venture philanthropy?¶

Venture philanthropy is one of the most effective tools in the social investment and philanthropy toolkit. It has emerged in Europe as a high-engagement approach to social investment and grantmaking across a wide range of SPOs. It can be applied in both charities and non-profit organisations and socially-driven businesses.

Social investment refers to funding that may generate a financial return, but where societal impact comes first – the so-called Impact First strategies. Grant funding on the other hand means non-repayable donations are made to the social purpose organization supported – an Impact Only strategy.

Finance first strategies, where the financial return is maximised and the societal impact is secondary, are not included in EVPA’s definition of venture philanthropy.

Investopedia¶

Venture philanthropy is the application or redirection of principles of traditional venture capital financing to achieve philanthropic endeavors.

Rockefeller Foundation¶

According a report from Rockefeller Foundation, the report did find an “overlapping set of characteristics” that many venture philanthropy efforts share, although not all occur in every case:

- Strategic framing which coordinates targeted resources (grants and/or investments), so that collectively they create systemic change

- Scales of intervention that address systems and sectors, rather than individual organizations or projects

- Sector focuses that tend to be cross-sectoral, engaging civil society, markets, and/or governments as needed

- Funding mechanisms that blend grants and investments, as appropriate to the theory of change

- Engagement styles that are more hands-on, using extended interactions with and sometimes between grantees

- Engagement periods that reflect the goal of systems changes, often five to ten years rather than one to two years.

- Culture and capabilities that are focused on innovation and experimentation

- Monitoring and evaluation that allows quick adaptation and focuses on outcomes and impacts.

Above part quote from Eileen Cunniffe

Impact Investing vs. Venture Philanthropy¶

This part quote link

Impact investing and venture philanthropy might appear the same, but there are several differences.

Venture philanthropy has been around much longer, as the phrase was coined by John D. Rockefeller III in 1969. His idea of venture philanthropy was as follows:

“An adventurous approach to funding unpopular social causes.”

Venture philanthropy peaked in popularity in the mid- to late-1990s.

Impact investing became a reality in 2007, when the phrase was coined at The Rockefeller Foundation. The given definition of impact investing at that time: “Mobilizing large pools of private capital from new sources to address the world’s most critical problems.”

Notice that venture philanthropy specifically focuses on social causes while impact investing has the broader remit of social and environmental causes. Both generally aim for a financial return while making a positive impact on the world, but not all venture philanthropy features the financial return piece.

Impact Investing¶

Impact investing, with the dual goal of making a profit and causing positive social and/or environmental improvements, can take place in a developed or emerging market. In emerging economies, microfinance projects are a popular approach, but impact investing also funds improving employment and education opportunities, supporting sustainable agriculture, making healthcare or housing affordable, and developing clean technology. It often is done through private equity, debt or fixed-income securities.

Many large corporations — including Apple Inc. , Tesla Motors Inc. General Electric Co. and First Solar Inc. — have stepped up to the plate to reduce the carbon footprint in their supply chain. When you see that a private or public company is taking this approach, putting some money behind that company would be a form of impact investing. You can also start impact investing through a variety of ETFs and Mutual Funds.

Impact investing is experiencing explosive growth. Assets in the sector are expected to grow to 500 billion USD by 2019, from 50 billion USD in 2009, and some predict assets ultimately will hit as high as $3 trillion.

Venture Philanthropy¶

Venture philanthropy is more focused on capital building than general operating expenses, and there is a lot of involvement with the grantees to help drive innovation. There also is a lot of emphasis on performance measurement, with the primary goal of improving systems and sectors as opposed to promoting individual organizations and funding individual projects. (For related reading, see: Top Trends in Corporate Social Responsibility.)

The engagement period for venture philanthropy is a minimum of three years and an average of five to seven years. With impact investing, there is no time frame. It’s more of a “as long as it takes” approach. Most venture philanthropy investments are done through a foundation or a private equity firm.

The Bottom Line¶

With impact investing, the investor is looking to make a profit while also having a positive impact on the world in a social or environmental sense. With venture philanthropy, the goal is usually (but not always) to make a profit while having a positive social impact on the world. Impact investing is on the rise while venture philanthropy seems to have passed its peak.